With the PM imposing a national lockdown in England as of 5th January 2021 hasn’t exactly kicked off to an ideal start. However, as it stands the property market remains open during lockdown 3.0 - and we’ve rarely been busier.

With the future uncertain, many prospective homeowners are keen to flee densely populated city centres in search of properties in more remote areas. But increased demand comes at a price, so it’s no surprise that we’re receiving requests for mortgages in excess of £300k.

If you’re seeking a mortgage of £320,000 (or any other amount, for that matter), read on - this guide will prepare you for what to expect in a market where lender requirements are more stringent than ever.

In a hurry to get the ball rolling? Give us a call on 02380 980304 or contact us and one of our expert advisors will be in touch.

How do I know if I’m eligible for a £320k mortgage?

Using a mortgage calculator can give you a rough estimation as to how much you could borrow based on your income and deposit size, but to find your true eligibility and the most suitable provider, it’s best to speak to a broker.

Our team of advisors will consider a whole host of other factors relating to your individual circumstances (which can often be the make or break of an application) and, using their expertise and extensive market knowledge, point you in the right direction.

To source the most suitable lenders and to prepare you for the questions most providers will ask you before taking you on as a customer, our brokers will ask for information surrounding the following:

Deposit size.

Mortgage type.

Income and outgoings.

Job type.

Credit history.

Your age.

Even if you already have a provider in mind, we can help you fill out your mortgage application. And because we have access to over 100 UK banks and specialist lenders, we may even be able to find you a more competitive deal.

What size deposit do I need for a £320,000 mortgage?

Historically there have been a number of 5% deposit mortgage incentives available, but nowadays they are few and far between. And the minority of lenders that do offer them often have strict, often unrealistic terms and are unlikely to offer the most competitive deal.

In 2021, a deposit of 15% - 20% of a property’s value is the standard requirement for residential mortgages - although there are still some competitive 10% deposit (90% loan-to-value) options available for the right applicant.

If you’re looking for a buy-to-let mortgage or secure a commercial loan, deposit requirements are usually even higher, usually between 25 - 40%, as repayments are reliant on rental income from tenants and are therefore a higher risk investment.

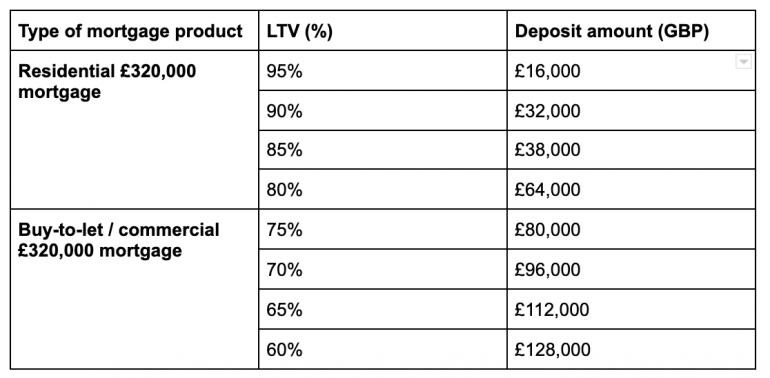

Here’s a breakdown of deposit requirement variations by product and loan-to-value (LTV) for a £320k mortgage:

That being said, lender requirements are all different and your other circumstances will have an impact on your mortgage terms. Always check with a broker to find the best deal and to avoid a rejected application.

How much do I need to earn to get a £320k mortgage?

Some lenders have minimum income requirements (or minimum taxable income thresholds for self-employed applicants).

As a starting point, many use income multiples of 4 - 4.5 x your annual salary to calculate how much they are willing to lend to you. For example, if you wanted to borrow £320k, you would need to earn a minimum of £80,000 - £71,200 respectively.

If you’re applying for a joint mortgage, your combined income can be included on your application.

How does affordability impact my application?

However, evidence of income alone isn’t enough; mortgage providers will check your true affordability by calculating your debt-to-income (DTI) ratio, to check that your disposable income can comfortably cover your repayments alongside your fixed monthly outgoings.

This is calculated by dividing your fixed monthly expenses by your income and multiplying by 100 (as a percentage). While a DTI of 35%+ is deemed ‘healthy’, lenders are likely to stress-test how the addition of a new mortgage impacts your affordability.

If you’re thinking of applying for a mortgage it’s critical that you avoid applying for or making purchases on credit in the months leading up to, and during, a property purchase - so keep an eye on your outgoings and see if there’s anyway you can boost your affordability.

How do I provide evidence of my income?

If you’re in full- or part-time employment, your lender will likely ask for evidence of your income in the form of bank statements, payslips and P60s.

If you’re self-employed, most mortgage providers will want to see at least one of the following:

Two or three years’ certified accounts.

SA302 forms.

An HMRC tax year overview for the past two to three years.

Many people think it will be difficult to secure a mortgage if you’re self-employed, but providing you meet the requirements there’s no reason your application shouldn’t be considered - there are even niche lenders specialising in self-employed mortgages.

Our brokers have extensive knowledge of the mortgage landscape in 2021, and can point you in the direction of the most suitable lenders and favourable deals, whatever your circumstances. Get in touch to speak to an expert.

I had a history of bad credit: can I get a mortgage of £320k?

Lots of people are under the impression that they will be unable to get a mortgage if they have a history of bad credit, but that’s not always the case. Many lenders make a decision based on how long ago the instance occurred and / or the severity of the issue.

If you’ve got one or more of the severe instances such as CCJs, IVAs or recurring missed or late loan payments on your record, it’s strongly recommended that you seek assistance from a broker - especially if this has occurred recently.

Our experts can assess your eligibility and recommend lenders most likely to provide bad credit mortgages, or give you tips on how to build your credit score. A rejected application can further negatively impact your score, which you’ll want to avoid at all costs.

Why does age impact a mortgage application?

If you’re 55+ and / or approaching retirement, you may find it more difficult to secure a mortgage, especially with high-street lenders. Many impose lending caps or shorter term lengths due to the additional risk posed.

This is because older applicants are more prone to poor health, and the impact on your affordability when you no longer have a regular salary coming in post-retirement (although if you have substantial savings this may not be an issue).

Whatever your circumstances, if you seek the right advice we’ll do all we can to find you a favourable deal for your needs - our brokers have access to a number of specialist lenders and can recommend those best suited for older borrowers.

Check your eligibility with a broker

To find out whether you’re eligible for a £320,000 mortgage, why not ask a broker to compare your options and check on your behalf? It saves you the hassle, won’t damage your credit score, and best of all - it’s free.

If you have any other questions or require assistance with your mortgage application, speak to a member of our team for advice. Give us a call on 02380 980304 or submit a request for a call-back.